Vision & Strategic Goals

The Budget reinforces the Government’s commitment to:

- Accelerating economic growth

- Ensuring inclusive development

- Enhancing private sector investments

- Strengthening household confidence

- Increasing spending power of the rising middle class

Guiding Principles & Budget Theme

The vision for Viksit Bharat includes:

- Zero poverty

- Universal access to quality education

- Affordable and comprehensive healthcare

- A skilled workforce with meaningful employment

- 70% participation of women in economic activities

- India as the ‘Food Basket of the World’

- Key Development Priorities

The Budget outlines ten strategic focus areas, with a targeted approach towards Garib (Poor), Youth, Annadata (Farmers), and Nari (Women):

- Spurring Agricultural Growth & Productivity

- Strengthening Rural Prosperity & Resilience

- Ensuring Inclusive Growth for All

- Boosting Manufacturing & ‘Make in India’

- Supporting MSMEs

- Driving Employment-led Growth

- Investing in People, Economy, & Innovation

- Securing Energy Supplies

- Expanding Export Opportunities

- Promoting Innovation & Technology

- Framework for Growth & Development

The Budget’s approach is structured around:

- Four Growth Engines: Agriculture, MSMEs, Investment, and Exports

- The Driving Force: Comprehensive Structural Reforms

- Core Philosophy: Inclusivity & Sustainable Development

- Ultimate Goal: Achieving Viksit Bharat

Transformational Reforms & Future Roadmap

To sustain economic momentum and enhance global competitiveness, the Budget prioritizes six key reform areas over the next five years:

- Taxation Reforms

- Power Sector Modernization

- Urban Development Initiatives

- Mining Sector Reforms

- Financial Sector Strengthening

- Regulatory Framework Enhancement

Proposed Financial Sector Reforms and Development

1. Increased FDI Limit in Insurance Sector

- The Foreign Direct Investment (FDI) limit in the insurance sector will be raised from 74% to 100%.

- This enhanced limit applies to companies that invest the entire premium within India.

- The existing foreign investment regulations will be reviewed and simplified.

2. Expansion of India Post Payment Bank Services

- India Post Payment Bank will expand and deepen its services in rural areas, improving financial inclusion.

3. Credit Enhancement Facility by NaBFID

- NaBFID will establish a Partial Credit Enhancement Facility to support corporate bonds for infrastructure development.

4. Introduction of ‘Grameen Credit Score’

- Public Sector Banks will develop a Grameen Credit Score framework to assess and fulfill credit needs of Self-Help Group (SHG) members and rural populations.

5. Pension Sector Reforms

- A new regulatory forum will be set up to coordinate and develop pension products, enhancing financial security.

6. KYC Process Simplification

- The revamped Central KYC Registry will be launched in 2025 for simplified onboarding.

- A streamlined periodic KYC updating system will also be introduced.

7. Streamlined Company Mergers

- Approval requirements and procedures for company mergers will be rationalized.

- The fast-track merger process will be expanded and simplified.

8. Revamping Bilateral Investment Treaties (BITs)

- Following the signing of two BITs in 2024, the existing BIT model will be revised to encourage sustained foreign investment while promoting the ‘First Develop India’ initiative.

9. Strengthening Regulatory Reforms

- The government is committed to modernizing outdated regulations and adopting a light-touch, trust-based regulatory framework to:

- Foster innovation and global competitiveness.

- Enhance Ease of Doing Business.

- Update regulations to align with technological advancements and global policies.

10. Establishment of a High-Level Committee for Regulatory Reforms

- A High-Level Committee will be formed to review all non-financial sector regulations, certifications, licenses, and permissions.

- The committee will submit recommendations within a year, focusing on:

- Strengthening trust-based economic governance.

- Reducing compliance burdens and inspections.

- Encouraging state-level participation.

12. Enhancing the FSDC Mechanism

- Under the Financial Stability and Development Council (FSDC), a mechanism will be developed to:

- Assess the impact of current financial regulations.

- Improve regulatory responsiveness and sectoral growth.

13. Introduction of ‘Jan Vishwas Bill 2.0’

- Building on the Jan Vishwas Act 2023, which decriminalized 180+ legal provisions, the government will introduce Jan Vishwas Bill 2.0 to further decriminalize 100+ legal provisions across various laws.

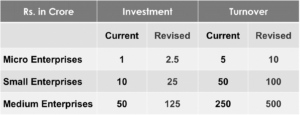

Proposed Changes in MSME Classification Criteria

- The investment and turnover limits for classifying Micro, Small, and Medium Enterprises (MSMEs) will be enhanced by 2.5 times and 2 times, respectively.

This revision aims to support MSMEs in achieving greater economies of scale, technological advancements, and improved access to capital.

Revised classification are as below:

Proposed Amendments w.r.t In-Direct Taxes

A.1 Amendments in the Customs Act, 1962

- Time Limit for Provisional Assessment:

- New Sub-section (1B) in Section 18: Sets a two-year time limit for finalizing provisional assessments, extendable by one year by the Commissioner of Customs upon sufficient cause.

- Applicability to Pending Cases: The time limit for pending cases starts from the date of assent to the Finance Bill, 2025.

- Suspension of Time Limit:

- New Sub-section (1C) in Section 18: Lists grounds for suspending the two-year time limit for provisional assessment finalization.

- Voluntary Revision of Entry Post Clearance:

- New Section 18A: Allows importers/exporters to revise any entry within a prescribed time and under specified conditions.

- Revised Entries: Considered self-assessment, enabling payment of duty or refund claims under Section 27.

- Exemptions: Specifies cases where this section does not apply.

- Clarification on Refund Time Limit:

- New Explanation in Section 27(1): States that refund claims following a revised entry under Section 18A or amendment under Section 149 must be made within one year from duty payment.

- Determination of Relevant Date:

- New Clause in Explanation 1 to Section 28: Defines the relevant date as the date of duty or interest payment under Section 18A.

- Settlement Commission & Interim Board:

- New Clause in Explanation 1 to Section 127A: Defines “Interim Board,” “Member of the Interim Board,” and “pending applications.”

- Amendments to Sections 127B, 127C, 127D, 127F, 127G, and 127H:

- Establishes the Interim Board’s authority over pending applications and cases.

- Grants the Interim Board powers similar to the Settlement Commission.

- Effective Date: These amendments take effect from the date of assent to the Finance Bill, 2025.

A.2 Amendments in the Customs Tariff Act, 1975

- Modifications to the First Schedule:

- Tariff Rate Revisions: Adjusts duties on select industrial items.

- New and Modified Entries:

- Adds 178 tariff entries in Chapters 10, 20, 27, 28, 29, 38, and 71.

- Replaces or deletes 63 entries.

- Inserts/amends supplementary notes for better WCO classification alignment.

- Effective Date: Changes take effect from May 1, 2025.

B. Legislative Changes in the CGST Act, 2017

(Changes will take effect upon notification, based on GST Council recommendations.)

B.1 Amendments in Section 2 of CGST Act, 2017

- Input Tax Credit Distribution:

- Clause (61) Amendment: Explicitly includes reverse charge inter-state supplies under the Input Service Distributor mechanism. (Effective April 1, 2025)

- Clarifications & New Definitions:

- Clause (69)(c) Amendment: Inserts definitions for ‘Local Fund’ and ‘Municipal Fund’ under ‘local authority.’

- New Clause (112A): Defines Unique Identification Marking for Track and Trace Mechanism.

B.2 – B.7: Other Key GST Amendments

- Time of Supply for Vouchers:

- Omission of Section 12(4) & Section 13(4): Removes provisions on time of supply for vouchers.

- ITC Restrictions Revision:

- Section 17(5)(d) Amendment: Changes “plant or machinery” to “plant and machinery” (Retrospective effect from July 1, 2017).

- Input Tax Credit Distribution (ISD):

- Section 20 Amendment: Adds provisions for inter-state supply ITC distribution. (Effective April 1, 2025)

- Tax Liability Reduction via Credit Notes:

- Section 34 Amendment: Requires ITC reversal by recipients for supplier tax liability reduction.

- Input Tax Credit Statement Modifications:

- Section 38 Amendments:

- Omits “auto-generated” references.

- Expands scope by adding “including” before “by the recipient.”

- Inserts new clause (c) to allow additional details in ITC statements.

- Section 38 Amendments:

- Return Filing Restrictions:

- Section 39(1) Amendment: Introduces enabling provisions for filing restrictions and conditions.

B.8 – B.11: Appellate Process & New Mechanisms

- Mandatory Pre-deposit for Appeals:

- Section 107(6) & Section 112(8) Amendments: Requires 10% penalty pre-deposit for penalty-only appeals before Appellate Authority and Tribunal.

- New Track & Trace Mechanism Provisions:

- New Section 122B: Introduces penalties for non-compliance with Track and Trace Mechanism under Section 148A.

- New Section 148A: Establishes the Track and Trace Mechanism framework for specified commodities.

- Schedule III Amendments (Retrospective from July 1, 2017):

- Insertion of New Entry (aa) in Paragraph 8: Treats certain SEZ and FTWZ transactions as neither supply of goods nor services.

- Explanatory Amendments:

- Clarifies applicability of existing explanations.

- Defines key terms such as ‘SEZ,’ ‘FTWZ,’ and ‘DTA.’

- Refund Restrictions: No refunds for past transactions.

- Other Provisions in the Finance Bill

- Service Tax Exemptions (Retrospective from April 1, 2011 – June 30, 2017):

- Reinsurance Services for Crop Insurance (WBCIS & MNAIS) exempted from service tax.

- Customs Duty Rate Changes (Effective February 2, 2025)

D.1: Duty Reductions

- Aquafarming & Marine Exports:

- Frozen fish paste: 30% → 5%

- Fish hydrolysate for feed: 15% → 5%

- Chemicals:

- Pyrimidine/piperazine compounds: 10% → 7.5%

- Synthetic flavoring essences: 100% → 20%

- Sorbitol: 30% → 20%

- Scrap & Critical Minerals:

- Various metal scraps: 5-10% → Nil

- Drugs & Medicines:

- 6 more medicines added to List 3: Duty capped at 5%

- 36 medicines added to List 4: Nil duty

- Textile, Handicraft & Leather:

- Wet blue leather: 10% → Nil

- Capital Goods & Electronics:

- Equipment for lithium-ion battery manufacturing: Nil duty

D.2: Duty Increases

- Textiles:

- Knitted Fabrics: 10-20% → 20% or ₹115/kg, whichever is higher

- Electronics:

- Interactive Flat Panel Displays: 10% → 20%

D.3: Tariff Rate Reduction (No Effective Rate Change)

- Examples:

- Glycerol crude: 30% → 20%

- Phosphoric Acid: 20% → 7.5%

- PVC flex films: 25% → 20% (+7.5% AIDC)

- Footwear: 35% → 20% (+18.5% AIDC)

- Various steel & iron products: 25% → 15%

Proposed Amendments w.r.t Direct Taxes

Proposed Amendments to Personal Income-Tax and TDS/TCS

(i) Personal Income-Tax Reforms

- Revised Tax Slabs under the New Tax Regime:

-

- Up to ₹4,00,000 – Nil

- ₹4,00,001 to ₹8,00,000 – 5%

- ₹8,00,001 to ₹12,00,000 – 10%

- ₹12,00,001 to ₹16,00,000 – 15%

- ₹16,00,001 to ₹20,00,000 – 20%

- ₹20,00,001 to ₹24,00,000 – 25%

- Above ₹24,00,000 – 30%

- Enhanced Rebate for Resident Individuals:

-

- Currently, individuals with an income up to ₹7,00,000 do not pay tax under the new regime due to a rebate.

- The proposed amendment increases this rebate, ensuring no tax liability for individuals earning up to ₹12,00,000.

- Marginal relief applies to incomes slightly above ₹12,00,000.

- Illustrative Tax Benefits:

| Income (₹) | Present Tax (₹) | Proposed Tax (₹) | Rebate Benefit (₹) | Total Benefit (₹) | Tax Payable (₹) |

| 8,00,000 | 30,000 | 20,000 | 10,000 | 30,000 | 0 |

| 9,00,000 | 40,000 | 30,000 | 10,000 | 40,000 | 0 |

| 10,00,000 | 50,000 | 40,000 | 10,000 | 50,000 | 0 |

| 11,00,000 | 65,000 | 50,000 | 15,000 | 65,000 | 0 |

| 12,00,000 | 80,000 | 60,000 | 20,000 | 80,000 | 0 |

| 16,00,000 | 1,70,000 | 1,20,000 | 50,000 | 50,000 | 1,20,000 |

| 20,00,000 | 2,90,000 | 2,00,000 | 90,000 | 90,000 | 2,00,000 |

| 24,00,000 | 4,10,000 | 3,00,000 | 1,10,000 | 1,10,000 | 3,00,000 |

| 50,00,000 | 11,90,000 | 10,80,000 | 1,10,000 | 1,10,000 | 10,80,000 |

(ii) Rationalization of TDS/TCS for Ease of Compliance

- Reduction in TDS/TCS Rates:

- To simplify tax compliance, the following TDS/TCS rates have been reduced:

| Section | Description | Present TDS/TCS Rate | Proposed TDS/TCS Rate |

| 194LBC | Income from investment in securitization trust | 25% (Individual/HUF) & 30% (others) | 10% |

| 206C(1) | TCS on timber/forest produce (not tendu leaves) obtained under lease or other modes | 2.5% | 2% |

| 206C(1G) | TCS on remittance under LRS for education financed by a loan | 0.5% after ₹7,00,000 | Nil |

- Increase in TDS/TCS Thresholds:

- To reduce the tax deduction burden, the following threshold limits have been increased:

| Section | Description | Present Threshold (₹) | Proposed Threshold (₹) |

| 193 | Interest on securities | Nil | 10,000 |

| 194A | Interest (other than securities) | ₹50,000 (Sr. Citizen), ₹40,000 (others – banks), ₹5,000 (others) | ₹1,00,000 (Sr. Citizen), ₹50,000 (others – banks), ₹10,000 (others) |

| 194 | Dividend for individual shareholders | ₹5,000 | ₹10,000 |

| 194K | Income from mutual fund units | ₹5,000 | ₹10,000 |

| 194B | Winnings from lottery, crossword puzzles | Aggregate exceeding ₹10,000 (FY) | ₹10,000 per transaction |

| 194BB | Winnings from horse races | ₹10,000 | ₹10,000 per transaction |

| 194D | Insurance commission | ₹15,000 | ₹20,000 |

| 194G | Commission on lottery tickets | ₹15,000 | ₹20,000 |

| 194H | Commission or brokerage | ₹15,000 | ₹20,000 |

| 194-I | Rent | ₹2,40,000 (FY) | ₹50,000 per month |

| 194J | Professional/technical fees | ₹30,000 | ₹50,000 |

| 194LA | Compensation for land acquisition | ₹2,50,000 | ₹5,00,000 |

| 206C(1G) | TCS on remittance under LRS & overseas tour packages | ₹7,00,000 | ₹10,00,000 |

(iii) Encouraging voluntary compliance

- Extension of Time-Limit for Filing Updated Return

- The time limit for filing an updated return is proposed to be extended from 24 months to 48 months from the end of the relevant assessment year.

- Additional tax payable shall be:

- 60% of the aggregate tax and interest payable for returns filed between 24 to 36 months.

- 70% for returns filed between 36 to 48 months, subject to conditions.

- Obligation to Furnish Information on Crypto-Assets

- A prescribed reporting entity dealing with crypto-assets shall furnish transaction details as per prescribed norms.

- The definition of “virtual digital asset” will be aligned accordingly.

- Simplification of Annual Value for Self-Occupied Property

- The annual value of a house or any part thereof shall be deemed nil if:

- It is self-occupied by the owner.

- It cannot be occupied due to valid reasons.

Reducing Compliance Burden

- Omission of TCS on Sale of Specified Goods

- No tax shall be collected at source for the sale of specified goods exceeding ₹50 lakhs, reducing compliance burden for taxpayers.

- Removal of Higher TDS/TCS for Non-Filers

- Sections 206AB and 206CCA will be omitted, eliminating higher TDS/TCS rates for non-filers.

- Rationalization of “Forest Produce” Definition

- The definition under Section 206C(1) will be clarified to remove ambiguity.

- TCS will be collected only on “any other forest produce obtained under a forest lease”.

Ease of Doing Business

- Extension of Tax Benefits for Startups (Section 80-IAC)

- The tax benefit for eligible startups is extended for five years, applicable to those incorporated before April 1, 2030.

- Parity in Long-Term Capital Gains for Non-Residents

- Taxation of long-term capital gains for non-residents, including Foreign Institutional Investors (FIIs), will be aligned with residents.

- Simplification of Tax Provisions for Charitable Trusts

- Registration validity for smaller trusts/institutions increased from 5 years to 10 years.

- Minor defaults will not lead to cancellation of registration.

- Definition of “substantial contributors” will be rationalized to ensure fair exemption denial.

- Rationalization of Taxation for Business Trusts

- Business trusts taxed at maximum marginal rate will also be subject to Section 112A, aligning it with Sections 111A and 112.

- Harmonization of Significant Economic Presence with Business Connection

- Non-resident transactions confined to the purchase of goods for export will be excluded from Significant Economic Presence.

- Clarity on Income from Redemption of Unit Linked Insurance Policies (ULIP)

- Profits from non-exempt ULIP redemptions shall be taxed as capital gains.

- Amendment to the Definition of “Capital Asset”

- The definition will be updated to clarify taxability of investment fund securities (Section 115UB).

- Rationalization of Transfer Pricing Provisions

- Multi-year transfer pricing adjustments will apply over a 3-year period.

- Exemption from Prosecution for TCS Delays

- Exemption from prosecution will be granted if the TCS amount is deposited before filing the quarterly TCS statement.

Employment & Investment

- Incentives for IFSC

- Various tax benefits and exemptions for International Financial Services Centre (IFSC) extended until March 31, 2030.

- Exemptions extended for:

- Life insurance proceeds issued by IFSC intermediaries.

- Capital gains on ship leasing equity transfers.

- Dividends from ship leasing IFSC companies.

- Intra-group treasury transactions.

- Fund managers under IFSC safe harbor regime.

- Non-deliverable forward contracts with FPIs in IFSC.

- Exchange-traded fund relocations.

- Extension for Investments by Sovereign Wealth & Pension Funds

- Investment deadlines extended from March 31, 2025, to March 31, 2030.

- Exemptions on long-term capital gains under Section 10(23FE) will apply even if reclassified as short-term gains under Section 50AA.

- Presumptive Taxation for Non-Residents in Electronics Manufacturing

- A presumptive taxation regime will be introduced for non-residents engaged in setting up or operating electronics manufacturing facilities in India.

- Expansion of Tonnage Tax Scheme

- The Tonnage Tax Scheme will be extended to inland vessels under the Indian Vessels Act, 2021, promoting Inland Water Transport.

- Deduction for Contributions to NPS Vatsalya

- Section 80CCD tax benefits extended to contributions made to NPS Vatsalya accounts.

Other Miscellaneous Amendments

- Exemption for Withdrawals from National Savings Scheme (NSS)

- Withdrawals from NSS after August 29, 2024, will be exempt for deposits and accrued interest where a deduction was claimed earlier.

- Increase in Perquisite Income Limits for Employees

- Section 17 will be amended to provide powers for revising perquisite income limits.

- Extension of Exemption to SUUTI

- Specified Undertaking of UTI (SUUTI) exemption extended until March 31, 2027.

- Non-Applicability of Section 271AAB

- The penalty under Section 271AAB will not apply to searches initiated on or after September 1, 2024.

- Penalty Amendments

- Assessing Officers will impose penalties subject to prior approval from the Joint Commissioner of Income Tax.

- Removal of Date Restrictions for Faceless Schemes

- The March 31, 2025 deadline for notifying faceless schemes will be removed.

- Processing Period for Penalty Immunity Applications

- Assessing Officers must accept/reject immunity applications within three months from the end of the month in which they were received.

- Time Limit for Tonnage Tax Scheme Applications

- Section 115VP amended to require orders within three months from the end of the quarter of application submission.

- Exclusion of Court-Stayed Periods in TCS Orders

- Time limits for deeming a person in default for TCS failure will exclude periods affected by court stays.

- Rationalization of Time Limit for Imposing Penalties

- Penalty orders must be issued within six months from the end of the quarter in which proceedings conclude or appeal order is received.

- Clarification on Stay Orders

- Amendments will specify the start and end date of periods affected by court stay orders.

- Rationalization of Time Limit for Retention of Seized Documents

- Seized documents must be retained only for one month after the end of the relevant quarter.

- Changes to Loss Carry-Forward Rules

- Losses of amalgamated entities can be carried forward for a maximum of eight years from the first assessment year of computation.

- Block Assessment Amendments

- The definition of undisclosed income in block assessments will include virtual digital assets.

- Time limit for block assessment completion set at 12 months from the end of the quarter in which the last search or requisition was executed.

- Legislative Roadmap : The new Income-Tax Bill will be introduced next week

– Compliance Knowledge HUB, Aparajitha