Payroll Compliance Services

Who Needs Payroll Compliance Services?

Businesses of all sizes and industries need a reliable Payroll compliance service provider to ensure they meet regulatory requirements related to employee compensation. Whether you’re a startup or a large corporation with a Pan-India presence, these payroll processing services are crucial for maintaining legal compliance and operational integrity.

Our Comprehensive Services

At Aparajitha, a leading provider among payroll processing companies, our team of experts provides comprehensive Payroll Compliance Services to support your business at every stage, ensuring seamless operations and adherence to regulatory requirements:

Payroll Compliance Services

- Obtain/amend EPF, ESI, & EPT codes & generation of UAN in EPF

- Generation of Insured Person Number (IPN) in ESI

- Generation of Monthly Statutory Challans

Statutory Returns and Payments

- Preparation and submission of EPT statutory returns

- Remittance of EPT statutory payments

Record Maintenance

- Maintenance of payroll records and registers

- Handling notices and inspections

- Assistance during audits and assessments

Extended Support to Employees

- Monthly statutory challan generation & KYC updation for employees

- Online PF helpdesk to resolve queries for employees

- Facilitation of pension and EDLI benefits

Why Do You Need Payroll Compliance Services?

- Streamline Payroll Processes

- Protect Employee Rights

- Ensure Legal Compliance

- Avoid Penalties and Fines

- Stay Updated on Regulatory Changes

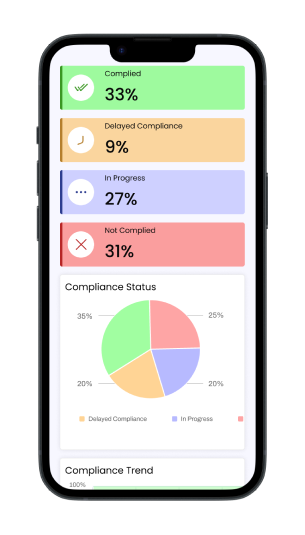

Mitigate Compliance Risks through Simpliance’s GRC platform

Our services include Simpliance’s Payroll Compliance Product suite to:

Track and monitor payroll compliance tasks

Gain real-time insights through reports and dashboards

Seamless EPF remittance and challan generation

Track and monitor compliance tasks

Gain real-time insights through reports and dashboards

Seamless EPF remittance and challan generation

Code-wise, location-wise, amount-wise challan(s) can be generated

Eliminate payroll compliance deviations

With Simpliance, a trusted payroll service provider, manage your business’s payroll compliance seamlessly. Gain a comprehensive overview of your payroll compliance status at all times.

Contact us today to discover how Simpliance can enhance your Payroll, Governance, Risk, and Compliance management!

Frequently asked questions

Payroll compliance refers to adhering to laws and regulations related to employee compensation, Professional Tax (PT), PF & ESIC contributions, Labour Welfare Fund (LWF) and other statutory obligations. It ensures that employers properly manage wages, deductions, and benefits in accordance with central and state-specific labour laws. Maintaining payroll compliance helps companies avoid penalties, fines, and legal issues, while also protecting employee rights.

“Payroll compliance management services are provided by external companies that specialize in payroll processing and compliance. These services typically include:

- Payroll Services: Obtain/amend EPF, ESI, & EPT codes. Generation of UAN & Monthly Statutory Challans

- Statutory Returns and Payments: Preparation and submission of EPT statutory returns & remittances of payments

- Record Maintenance: Maintenance of payroll records, registers & handling notices and inspections

- Extended Support to Employees: Monthly statutory challan generation & KYC updation for employees. Online PF helpdesk to resolve queries for employees”