INTRODUCTION

A non-banking financial company (NBFC) is a company registered under the Companies Act 2013, and its operations are regulated by the Reserve Bank of India (RBI) under the framework of Chapter III -B (Provisions Relating to Non-Banking Institutions Receiving Deposits and Financial Institutions). Although Chapter III exclusively dealt with NBFCs, the word NBFC was not defined until The RBI (Amendment) Act, 1997, by inserting clause (f) under Section 45-I, which defined Non-Banking Financial Company as –

- “a financial institution which is a company

- a non-banking institution which is a company and which has as its principal business the receiving of deposits, under any scheme or arrangement or in any other manner, or lending in any manner;

- such other non-banking institution or class of such institutions, as the Bank may, with the previous approval of the Central Government and by notification in the Official Gazette, specify;”

so, in this definition “financial institution” includes Section 45 I (c) of RBI Act, which sites that a company is also considered as NBFC if it carry on any of the activities listed below –

- “The financing, by way of making loans or advances or otherwise, of any activity other than its own,

- the acquisition of shares, stock, bonds, debentures or securities issued by a government or local authority or other marketable securities of a like nature:

- letting or delivering of any goods to a hirer under a hire-purchase agreement as defined in clause (c) of section 2 of the Hire-Purchase Act, 1972:

- the carrying on of any class of insurance business;

- managing, conducting or supervising, as foreman, agent or in any other capacity, of chits or kuries as defined in any law which is for the time being in force in any State, or any business, which is similar thereto;

- collecting, for any purpose or under any scheme or arrangement, monies in lumpsum or by way of subscriptions or by sale of units, or other instruments or in any other manner and awarding prizes or gifts, whether in cash or kind, or disbursing monies in any other way, to persons from whom monies are collected or to any other person,

but does not include any institution, which carries on as its principal business, –

- agricultural operations; or

(aa) industrial activity; or

(b) the purchase or sale of any goods (other than securities) or the providing of any services; or

(c) the purchase, construction or sale of immovable property, so however, that no portion of the income of the institution is derived from the financing of purchases, constructions or sales of immovable property by other persons;”

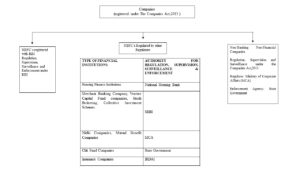

In a nutshell a Non-Banking Financial Company means and includes any business of financial institution referred under Section 45 I(c) and Section 45 I (f).In addition to RBI guidelines, NBFCs are regulated by NHB, SEBI, MCA IRDAI and State Government.

REGULATORS OF NON-BANKING COMPANIES

BACKGROUND OF NBFC’s

- Since the 1960s, non-banking financial companies (NBFCs) have emerged in India to cater to consumers and investors whose needs weren’t met by traditional banks. These NBFCs offer diverse financial services, including equipment leasing, loans, investment options, and even chit-fund operations.

- Initially, the Companies Act governed the financial sector. However, the unique and complex nature of financial operations and their role as financial intermediaries necessitated a distinct regulatory framework.

- In the 1970s, the Indian government tasked the Banking Commission, under the leadership of Bhabatosh Datta, with investigating the operations of chit funds and non-banking financial intermediaries.

- Besides the Banking Commission (1972), the James Raj Committee (1975) also examined the functioning of NBFCs. Both committees concurred on the inadequacy of the existing legislative framework and emphasized the need for improvement.

- Building upon the recommendations of the Chakravarty Committee (1985) for a tiered licensing system to safeguard depositors, the Narasimhan Committee (1991) established a comprehensive regulatory framework for NBFCs. This framework encompasses capital adequacy, debt-to-equity ratio limits, credit concentration controls, adherence to sound accounting practices, standardized disclosure requirements, and asset valuation standards.

- Furthermore, it emphasized the need for a dedicated supervisory agency under the Reserve Bank of India to oversee and regulate NBFCs.

- Further, the committees advocated for the creation of a supervisory body within the Reserve Bank of India to regulate NBFCs.

- During the 1980s and 1990s, Non-Banking Financial Institutions (NBFCs) experienced a significant increase in investor interest due to their reputation for customer-centricity. This resulted in a rapid expansion of the industry, with the number of NBFCs quadrupling from approximately 7,000 in 1981 to around 30,000 in 1992. This rapid growth prompted the Reserve Bank of India (RBI) to consider implementing a regulatory framework for the NBFC sector.

- In recognition of this need, a committee led by Professor Sukhamoy Chakravarty was convened in December 1982 by Dr. Manmohan Singh, the then-Governor of the Reserve Bank of India. The committee’s primary objective was to evaluate the functioning of the country’s monetary system. To achieve this, the committee recommended an analysis of the banking sector, non-banking financial institutions, and the unorganized sector, with a focus on understanding the impact of various monetary and credit policy tools.

- The Reserve Bank of India (RBI) took further steps towards regulating the NBFC sector in 1992. A committee chaired by Mr. A. C. Shah, former Chairman of Bank of Baroda, was established to propose effective regulatory measures. This committee recommended mandatory registration and adherence to prudential norms for NBFCs

- Building upon the recommendations of the Shah Committee and the Joint Parliamentary Committee’s observations from 1992, the RBI formed an Expert Group led by Mr. Khanna in April 1995. This group focused on designing a comprehensive supervisory framework for NBFCs. Their proposed framework included an off-site surveillance system and on-site examinations tailored to the size and business activities of each NBFC.

- Recognizing the need for a robust legal framework, the government enacted an Ordinance in January 1997, followed by an Act in March 1997. These legislative measures significantly amended Chapters III-B and V of the RBI Act, granting the central bank greater powers to regulate and supervise NBFCs.

CLASSIFICATION OF NBFC’s

The sector’s size, complexity, and level of interconnection within the financial sector have all changed significantly over time. The need to reconcile the regulatory framework for NBFCs with their evolving risk profile stems from the growth of numerous entities that have become systemically significant. In regard to this, a Revised Guideline on Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFC was issued on 2021, wherein the Regulatory Structure for NBFC’s introduced Four layers based on their size, nature of activity and risk associated, they are of 4 layers –

THE FOUR LAYERS AS PER SCALE BASED REGULATION

Recent Regulatory Changes and Trends

- Harmonization of NBFC Regulations: Efforts to bring NBFC regulations closer to those applicable to banks to ensure a level playing field and mitigate regulatory arbitrage.

- Revised Regulatory Framework for Core Investment Companies (CICs):Enhanced governance standards and stricter norms for CICs due to their significant role in holding companies.

- Introduction of Scale-Based Regulation: A scale-based approach to regulation where NBFCs are categorized into different layers (base, middle, upper, and top layers) based on their size, activity, and risk profile, with differentiated regulatory requirements.

- Focus on Technology and Innovation: Encouraging the adoption of fintech innovations while ensuring adequate regulatory oversight to manage associated risks.

Conclusion

The regulatory evolution of NBFCs in India reflects a concerted effort to foster a resilient, transparent, and inclusive financial ecosystem. By continuously adapting to the sector’s growth and complexity, regulatory authorities aim to safeguard the interests of depositors, maintain systemic stability, and support the sustained development of NBFCs as vital financial intermediaries in the Indian economy.