On 24th July 2019, the Government of Maharashtra revised the basic rate of minimum wages for the workers in the “employment of Shops and Commercial Establishments”. The revision was made after a gap of 9 years. It was done for Skilled, Semi-skilled and Unskilled workers. It was a 100% hike for all the three category of workers.

The Appropriate Governments are expected to revise the minimum rate of wages with the intervals not exceeding 5 years as per Sec 3(1)(b) of the Minimum Wages Act. But the Government of Maharashtra took 9 years for it now. Also, the draft notification for the revision was published way back in 2016 itself. There was an inordinate delay in clearing that too.

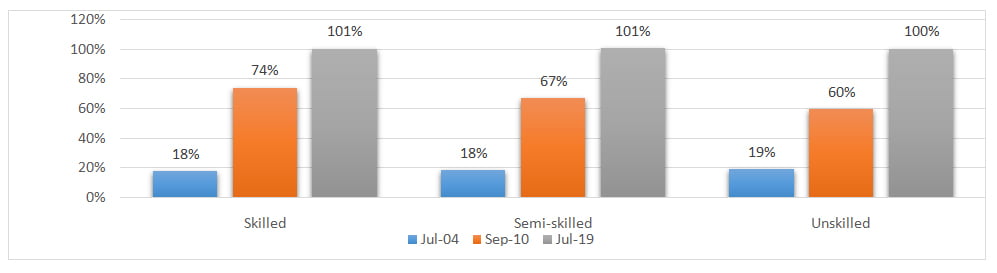

When we look at only the basic rate of wages for the ‘skilled’ workers, the hike worked out to 18% in 2004; 74% in 2010 and 101% now. The increase is more or less the same for the other two categories too. The graph and the matrix hereunder would give a clear picture

Trend – MW – Basic Hike Trend

S & E MW – Revision of Basic Rate:

| Type | Jul-04 | Sep-10 | Jul-19 | Jul-04 | Sep-10 | Jul-19 | Jul-04 | Sep-10 | Jul-19 |

| Zone I | Zone I | Zone I | Zone II | Zone II | Zone II | Zone III | Zone III | Zone III | |

| Skilled | 3330 | 5800 | 11632 | 3230 | 5500 | 11036 | 2930 | 5200 | 10440 |

| Semi-skilled | 3230 | 5400 | 10856 | 3130 | 5100 | 10260 | 2830 | 4800 | 9664 |

| Unskilled | 3130 | 5000 | 10021 | 3030 | 4700 | 9425 | 2730 | 4400 | 8828 |

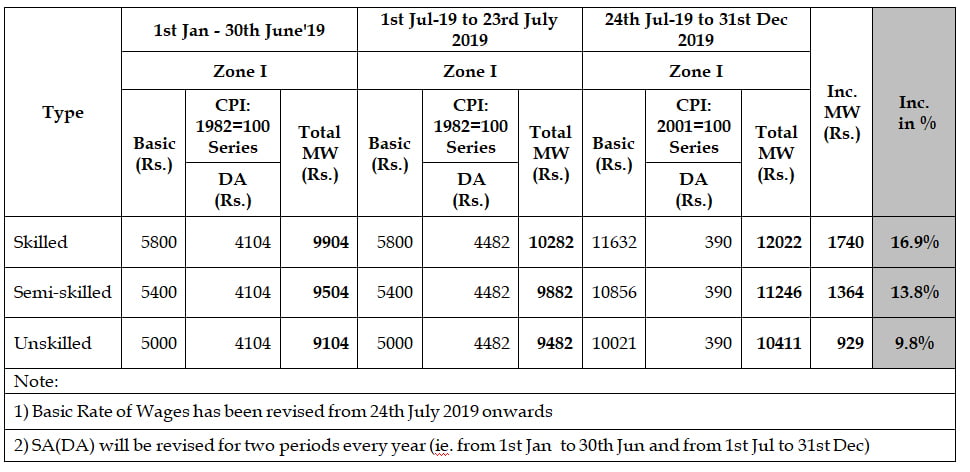

The special allowance, otherwise known as dearness allowance, shall be calculated on the Consumer Price Index (CPI) series keeping the base year 1982 = 100 as per the Basic rate notification issued in September 2010. For every point over and above 804 points, Rs 5.40 pm is to be paid. Thus, Special Allowance worked out to Rs 4104/- for the period from 1/1/2019 to 30/6/2019 for ‘employment in shops and establishments’. From 1/7/2019 to 23/7/2019, it was Rs 4482/-

Whereas, the base year is now changed as per the latest notification issued in July and it is with effect from 24/7/2019. As per the new series keeping the base year 2001 = 100, the average CPI base point is 329. For, every additional point thereon, Rs 26/- pm is to be paid. Therefore, the minimum wages to be worked out and paid to all the three categories of workers in ‘shops and establishments’ are shown in the following table:

The basic rate of wages is to be added with the Dearness Allowance for ensuring payment of minimum wages. What is evident from the above table is, while it is true that the basic rate is doubled as per the recent notification, the total minimum wage is not.

Of course, the revision will have impact on PF, ESI, Bonus, Gratuity and other perks too, as the contributions /payments are to be reckoned on these revised ratesnow.

The workers, particularly those who are paid merely the minimum rates of wages, would surely stand to gain, while the employers, particularly of MSME sector, may feel the increased financial burden.

Mathusoodhanan T

mathu@aparajitha.com