Directorate General of Foreign Trade – Relief Measures for Importer & Exporters for COVID-19 outbreak

Act: Foreign Trade (Development & Regulation) Act, 1992

The present Foreign Trade Policy which came into force on 1st April 2015, is originally for 5 years and has validity only up to 31st March 2020. In view of the unprecedented current situation arising out of the pandemic novel COVID-19, the Government of India has decided to continue the relief under various export promotion schemes by granting an extension of the existing Foreign Trade Policy by another one year i.e. up to 31st March 2021.

To handle the disruption caused by the Corona Virus disease (COVID-19) by the exporters and importers, special Relief Measures announced by amending the due dates prescribed in Hand Book of Procedures–2015-20 & Foreign Trade Policy 2015-20 by Directorate General of Foreign Trade( DGFT) and to reduce their compliance burden by providing extension in Export obligation period, EPCG Authorizations, an extension of the validity period of Status Certificate, relaxation in the issuance of Certificate of Origin and various extension in the date of filing of applications, forms and returns etc. through several notifications as detailed below:

Relief Measures for Exporters & Importers -Foreign Trade Policy 2015-20:

Source: Notification No. 57/2015-2020 dt.31/03/2020

Public Notice No. 67/2015-2020 dt.31/03/2020

Policy Circular No.35/2015-20 dt.23/04/2020

- Is there any extension granted for the enforceability of Foreign Trade Policy 2015-20 as it’s expired on 31st March’2020, and new policy not yet notified due to COVID-19 disruptions?

Yes, due to COVID-19 disruptions the existing Foreign Trade Policy 2015-20 shall remain in force up to 31st March 2021 unless otherwise specified. (Instead of expiring on 31st March’2020 as per Para 1.01 of FTP 2015-20)

- In the event of an extension of the applicability of FTP 2015-20 till 31st March’2021, will the SEIS scheme benefits extended to Service Providers of notified services?

As of now, the decision on continuation of the SEIS scheme not taken for availing benefits on the notified services rendered by the service providers with effect from 1st April’2020, a decision will be taken subsequently and notified accordingly

- Will there be any change in the rates of reward on notified services and the eligible service categories under existing SEIS scheme as per Para 3.08(a) of FTP 2015-20?

Yes, the service categories eligible under the SEIS scheme and the rates of reward on notified services as rendered w.e.f. 1st April 2019 to 31st March 2020 shall be notified separately in Appendix 3 X.

- Will the date for the Exemption from Integrated Tax and Compensation Cess under Advance Authorization under Para 4.14 of FTP 2015-20, due to extension of FTP 2015-20 validity?

Yes, the exemption from Integrated Tax and Compensation Cess under Advance Authorization under Para 4.14 of FTP 2015-20 has been extended till 31st March’2021 (instead of 31st March’2020 as per Notification No. 57/2018, DT. 20/03/2019).

- Will the date for the Exemption from Integrated Tax and Compensation Cess under EPCG Scheme under Para 5.01(a) of FTP 2015-20, due to extension of FTP 2015-20 validity?

Yes, the exemption from Integrated Tax and Compensation Cess under EPCG Scheme under Para 5.01(a) of FTP 2015-20 has been extended till 31st March’2021 (instead of 31st March’2020 as per Notification No. 57/2018, DT. 20/03/2019)

- Will the date for the Exemption from Integrated Tax and Compensation Cess under EOU scheme under Para 6.01(d)(ii) of FTP 2015-20, due to extension of FTP 2015-20 validity?

Yes, the Exemption from Integrated Tax and Compensation Cess under EOU scheme under Para 6.01(d)(ii) of FTP 2015-20 has been extended till 31st March’2021 (instead of 31st March’2020 as per Notification No. 57/2018, DT. 20/03/2019)

- Will there any extension provided for Duty-Free Import Authorisation (including transferable DFIAs), where the validity for import is expiring during COVID-19 disruption period as per 4.29(viii) of FTP 2015-20?

Yes, for all DFIAs (including transferable DFIAs), where the validity for import is expiring from 1st February’2020 to 31st July’2020, the validity stands automatically extended by 6 months from the date of expiry.

- Is there any extension provided for the import under EPCG Scheme to fulfil the export obligation from the date of issue of authorization if their validity expires during COVID-19 disruptions?

Yes, if the validity period for import under EPCG Scheme to fulfill the export obligation expires during 1st February, 2020 to 31st July, 2020, the validity stands automatically extended by further 6 months from the date of such expiry.

Relief Measures for Exporters & Importers –Handbook of Procedures 2015-20:

Source: Public Notice No. 67/2015-2020 dt.31/03/2020

- As the Handbook of procedures 2015-20 issued under The Foreign Trade (Development and Regulation) Act, 1992 & its rules, expired on 31st March’2020, is there any extension provided owing to COVID-19 outbreak?

Yes, as per Public notice issued on 31st March’2020, the Handbook of procedures 2015-20 shall remain in force until 31st March 2021 (instead of 31st March’2020) due to COVID-19 disruptions.

- Is there any extension given for a period of installation and operationalization of radiation portal monitors and containers scanners in the designated ports for import of metallic waste and scraps as it’s expired on 31st March’2020? ( PN.No.40/2015-20 dt.24th Dec’2019)

Yes, the deadline of installation and operationalization of radiation portal monitors and containers scanners in the designated ports for import of metallic waste and scraps has been extended to 30th September’2020 (instead of 31st March’2020)

- Will the seaports derecognized for the purpose of import of un-shredded metallic scarp w.e.f 01st Apr’2020, if they have not met the deadline for installing & operationalizing of Radiation portal monitors and Containers scanners as notified by PN.No.40/2015-20 dt.24th Dec’2019?

No, the deadline for by the seaports to install and operationalize Radiation portal monitors and containers scanners for the purpose of import of un-shredded metallic scarp has been extended to 01st October’2020.

- What if, when the recognition of Pre-shipment Inspection Agency (PSIA) is due for renewal by 31st March’2020 will their approval deemed as expired?

No, due to COVID-19 outbreak, any recognition is given for notified PSIA’s (as per Para 2.55(d) of HBP 2015-20) which has extended validity up to 31st March’2020 or whose recognition is valid till 29th June’2020, now deemed to be valid up to 30th June’2020.

- Any due date extended for submitting an application for obtaining Duty Credit Scrip’s under Merchandise Exports from India Scheme which is getting lapsed as on 31st March’2020?

Yes, for the shipping bills for which Let Export ( LEO) date falling during the period 1st February’2020 to 31st May’2020, the application for obtaining Duty Credit Scrip’s under Merchandise Exports From India Scheme shall be filed within a period of 15 months (Instead of 12 months as per Para 3.15(a)(i) of HBP 2015-20)

- What is the last date for submitting an application for obtaining Duty Credit Scrip’s under Service Exports from India Scheme for FY 2018-19 in view of COVID-19 outbreak?

The last date for filing application for obtaining Duty Credit Scrip’s under Service Exports from India Scheme for FY 2018-19 FY 2018-19 shall be 31st December’2020 ( instead of 12 months from the end of relevant financial year of claim period as per Para 3.15(b) of HBP 2015-20).

- What is the validity of Status Certificates issued under this Foreign Trade Policy 2015-20, as the FTP-2015-20 validity expiring on 31st March 2020?

The Status certificate issued under FTP 2015-20 is valid for a period of 5 years from the date on which application for recognition was filed or 31st March 2021 whichever is later (as per Para 3.20(a) of HBP 2015-20). This extension is provided in line with the extension of FTP 2015-20 validity to 31st March’2021 and owing to COVID-19 disruptions.

- What will be the validity of the norms ratified by the Norms Committee in respect of any advance authorization obtained for which SION is not fixed after 31st March’2020?

Norms ratified by any Norms Committee (NC) by the 0/o DGFT on or after 01.04.2015 in respect of any Advance authorization obtained by self-declared authorisations where SION does not exist, shall be valid for the extended period of the Foreign Trade Policy i.e. up to 31st March’2021 or for a period of three years from the date of ratification, whichever is later. (Instead of 31st March’2020 as per PN.25/2015-20 dt.14.08.2019 for Para 4.12(vi) of HBP 2015-20)

- What will be the validity period for import and revalidation of authorization as per Para 4.41(d) of HBP 2015-20 which is expiring from 01st February’2020 to 31st July’2020?

For all Advance Authorisations where the validity for import is expiring from 1st February’2020 to 31st July’2020, the validity stands automatically extended by six months from the date of expiry.

- Whether importer need to submit an application for extension of the validity period of import?

Not required, since no separate amendment/endorsement is required on the extended authorization’s as clarified vide Public Notice No. 67/2015-2020 dt.31/03/2020

- What will be the validity of export obligation period in respect of Advance Authorisation already issued prior to the imposition of the ban for export of any product since it will be extended automatically to the duration of the ban as per Para 4.42(h) of HBP 2015-20?

For Advance Authorisations already issued prior to the imposition of ban on the export of any product for which the Export Obligation period is expiring from 01st February’2020 to 31st July’2020, the Export Obligation period stands automatically extended by 6 months from the date of expiry. (Instead of extended for a period equivalent to the duration of the ban, without any composition fee).

- Whether exporter need to submit an application for extension of the validity of export obligation period in respect of Advance Authorisation?

Not required to submit the application with composition fee, since no separate amendment/endorsement is required on the extended authorizations’ as clarified vide Public Notice No. 67/2015-2020 dt.31/03/2020.

- Due to COVID-19 disruptions how to calculate the due date for filing an application for Replenishment authorization since there will be a delay in the realization of export proceeds or delay in exports against advance receipt?

For the Replenishment Authorisation applications where the last date of filing the application falls from 1st February’2020 to 31st July’2020 the last date stands extended by six months ( As per Para 4.59(e) of HBP 2015-20)

- Is there any extension provided for re-export of the imported diamonds for certification or grading, for which the last date of export falling from 1st February’2020 to 31st July’2020 owing to COVID-19 disruptions?

Yes, for re-export of imported diamonds for which the last date of exports falling from 01st Febraury’2020 to 31st July’2020, the last date has been extended by six months (instead of 3 months as per Para 4.75(c) of HBP 2015-20).

- Is there any extension provided for Export against supply by Foreign Buyer, for which the last date of export to status holder/ exporter falling from 1st February’2020 to 31st July’2020 owing to COVID-19 disruptions?

Yes, for completion of direct supply to the status holder/ exporter for which the last date of exports falling from 1st February’2020 to 31st July’2020, the last date has been extended by six months (instead of 90 days as per Para 4.77(c) of HBP 2015-20).

- What is the due dates for various conditions as mentioned in Para 4.80 of HBP of 2015-20 for export through Exhibitions or Export Promotion Tours or Export of branded jewellery for the below:

- Reimport of Exported Gems and Jewellery for holding/participating in the overseas exhibition not sold abroad in the exhibition Multiple Exhibition at a time (within 45 days of the close of the first exhibition, then 60 days shall be counted from the date of close of the last exhibition.If the Exhibition held in the USA (within 90 days from close of the exhibition) Replenishment from the nominated agency within 120 days from the close of the exhibition gold /silver /platinum for replenishment content against items sold abroad in the exhibition.

- Personal Carriage of gems & jewellery or export through airfreight/post parcel route for Export Promotion Tours/photoshoots/fashion shows overseas – Promoter would bring back jewellery /goods or repatriate sale proceeds within 45 days from date of departure through normal banking channel.

- Personal carriage of gems & jewellery for export promotion tours – exporter shall book with the nominated agency, within 120 days after export promotion tour or expiry of the stipulated period of 45 days, whichever is earlier, gold/silver/ platinum for replenishment content against items sold abroad.

- Export of branded jewellery with approval of Gem & Jewellery EPC for display/sale in permitted shops set up abroad or in the showroom of their distributors/ agents – Exporter shall book with the nominated agency within 120 days after the end of the stipulated period of 365 days, gold/silver/platinum for replenishment content against items sold abroad.

- Exhibitions organised by nominated agencies, gold/silver/platinum shall be imported as replenishment by nominated agencies within 60 days from close of the exhibition

In all the above cases for which the last date calculated, as per the duration mentioned above. If the last date is expiring from 1st February’2020 to 31st July’2020, the last date for the same has been extended by six months. This will include the extension in time for replenishment, booking with nominated agencies, and time allowed for re-import.

- Is there any relaxation provided for repatriation of sale proceeds for the items sold during exhibition abroad?

Yes, the relaxation in the repatriation of sale proceeds on items sold in exhibition or promotion abroad on the period would be equal to the period allowed plus 6 months, or as subject to RBI guidelines issued whichever is less. (As per RBI Guidelines issued on 31st March’2020 the amount representing the full export value of goods exported shall be paid to the authorised dealer as soon as it is realised and in any case within 15 months or such period as may be specified by the Reserve Bank, in consultation with the Government, from time to time from the date of shipment of goods)

- What is the last date for applying for replenishment of precious metal old/silver/platinum by the exporters to the nominated agencies under the replenishment scheme for the items falling from 01st Feb’2020 to 31st July’2020 as per Para 4.82 of HBP- 2015-20?

The last date of submitting the application for the replenishment of precious metals by the exporters to the Nominated agencies for which the due date expires from 1st February’2020 to 31st July’2020, the last date has been extended by 6 months.

- What will be the time limit for realization and repatriation of export proceeds for the precious metal in advance on outright purchase basis or on loan basis or exports against advance authorisation due to COVID-19 disruption?

In view of the disruption caused by the COVID-19 pandemic, the time period for realization and repatriation of export proceeds for exports made up to or on July 31, 2020, would be equal to the period as allowed plus 6 months ( as per para 4.82 of HBP 2015-20 ) or as per RBI guidelines whichever is less (As per RBI Guidelines issued on 31st March’2020 the amount representing the full export value of goods exported shall be paid to the authorised dealer as soon as it is realised and in any case within 15 months or such period as may be specified by the Reserve Bank, in consultation with the Government, from time to time from the date of shipment of goods).

- What is the last date for exporting precious metal in advance on outright purchase basis or on loan basis or exports against advance authorisation, for which the last date of export falling from 01st Feb’2020 – 31st July’2020 as per Para 4.83, 4.84 &4.85 of HBP- 2015-20?

The last date for exporting precious metal in advance on outright purchase basis or on loan basis or exports against advance authorization, for which the due date expires from 1st February’2020 to 31st July’2020, the last date has been extended by 6 months.

- Will there any extension provided for producing the certificate of installation of capital goods by the Authorisation holder as per Para 5.04(a) of HBP-2015-20 in view of COVID-19 Disruptions?

Yes, in case if the period of six months expires for submission of the certificate of installation of capital goods by the authorization holder to the regional authority during 1st February 2020 to 31st July 2020, then the period for submission of Installation Certificate is extended by further 6 months from the original due date.

- Is there any extension provided to the authorization holder under the EPCG scheme to fulfil the Block-wise Export obligation to submit within 3 months from the expiry of block as per Para 5.14(a),(c) & (d) of HBP-2015-20, owing to COVID-19 disruptions?

Yes, for all the authorisations covered under EPCG scheme as per para 5.14 (a), (c) and (d) of HBP-2015-20, for which if the block-wise export obligation period expires during 1st February 2020 to 31st July 2020, the period is deemed to be automatically extended by further 6 months from the date of such expiry.

- Will there be any change in Extension in Export Obligation Period of EPCG authorization owing to the COVID-19 disruptions?

Yes, for the authorisations covered under EPCG Scheme as per Para 5.17 (a), (b) and (c) of HBP-2015-20, for which the export obligation period expires during 1st February 2020 to 31st July 2020, such period is deemed to be automatically extended by further 6 months from the date of such expiry.

- In view of COVID-19 disruptions, is there any extension provided for Letter of Permission (LoP) / Letter of Intent (LoI) issued by DC / designated officer to EOU/ EHTP /STP / BTP unit for which the validity expires on or after 1st March 2020 as per Para 6.01(b) (ii) of HBP of 2015-20?

Yes, all Letter of Permission (LoP) / Letter of Intent (LoI) issued for EOU/ EHTP /STP / BTP unit for those the original or extended validity of LoP or LoI expires on or after 1st March 2020, it shall be deemed to be valid up to 31st December 2020 and extension, if necessary, will be granted by the Board of Approval.

- What will be the expiry date of the validity of obligation period for import of items {covered by Chapter 9 of ITC (HS)} and coconut oil for which the export obligation is not fulfilled fully or partly by EOU or BTP units in view of COVID-19 disruption?

The Export obligation period for import of items {covered by Chapter 9 of ITC (HS)} and coconut oil expires during 1st March 2020 to 30th June 2020, it would deem to be valid up to 30th September 2020 (instead of within a period of 90 days from the date on which first import consignment is cleared by Customs Authorities as per Para 6.06(c) (ii) of HBP- 2015-20).

- Is there any change in the frequency of application and extension in the time period for claiming Terminal excise duty TED/ Drawback which is expiry during the COVID-19 disruptions?

When the due date for claiming Terminal Excise Duty (TED)/ Drawback after realization of 100% payment against supplies or from the date of last supplies where the dates for submitting application fall on or after 1st March 2020, then the date for filing of applications for refund of TED/Drawback may be deemed to be extended up to 30th September 2020. (Instead of 12 months as per Para 7.05(a) of HBP-2015)

- Is there any extension given for filing the quarterly application for claiming a refund on transport and marketing assistance (TMA) for the quarter ending 31st March 2019 and 30th June 2019 owing to COVID-19 disruptions?

Yes, Application for refund of transport and marketing assistance(TMA) for the quarter ending 31st March 2019 and 30th June 2019 shall be filed up to 30th September 2020 ( Instead of 31st March 2020 and 30th June’2020 as per Para 7A.01(d) of HBP- 2015-20).

- Will late cut be imposed on any application for any fiscal/financial benefits under Foreign Trade Policy 2015-20 is submitted after expiry of original last date for submission of application as per Para 9.02 of HBP-2015-20?

No, the last date of submission of application, for the purpose of imposing late cut, would be taken as that extended vide Public Notice No. 67/2015-20 dated 31st March 2020, hence if any importer or exporter abide by the extended dates as above, shall not be liable for late cut imposition.

- Is there any extension provided for submitting Quarterly Performance report for the quarter ending March’2020 & June’2020?

Yes, Quarterly Performance report (QPR) for the quarter ending March’2020 & June’2020 shall be filed up to 30th September, 2020 owing to COVID-19 outbreak (Instead of 30 Days from the end of the quarter)

- Is there any extension provided for submitting Annual Performance report for the financial year ending on 31st March 2020?

Yes, Annual Performance Report (APR) for the financial year ending 31st March’2020 shall be filed up to 30th September 2020 owing to COVID-19 outbreak (Instead of 90 Days from the close of the financial year)

- Is there any extension provided for submitting Monthly Performance report for the months ending February’2020 to June’2020?

Yes, Monthly Performance Report (MPR) for the Months ending February’2020 to June’2020 shall be filed up to 30th September 2020 owing to COVID-19 outbreak (instead of 10 days from the end of the respective month)

- Is there any extension provided for submitting the application for reimbursement of Central sales tax (CST) on supplies made to Export Oriented Units ( EOU’s) and units in Electronic Hardware Technology Park ( EHTP) and Software Technology Park ( STP) for the quarter ending 30th September 2019 and 31st December 2019?

Yes, Owing to COVID-19 disruptions the application for claiming reimbursements of CST on supplies made to EOU/EHTP/STP for the quarter ending 30th September 2019 & 31st December 2019 shall be extended up to 30th September’2020. (Para 6.11 (c) (i) of FTP 2015-20)

- What is the Transport and Marketing Assistance Scheme validity any extension provided beyond 31st March’2020?

Yes, Vide Notification No. 17/3/2018-EP (Agri.IV) dated 17.03.2020 of the Department of Commerce, has extended the validity of the Transport and Marketing Assistance Scheme up to 31.03.2021.

Revalidations of Registration-cum-Membership Certificate

Source: Trade Notice No. 60/2015-2020 dt.31/03/2020

- If the RCMC of exporters expired on or before 31st March’2020, how the RCMC will be revalidated during this COVID-19 disruption by exporters?

The Regional Authorities (RAs) of DGFT will not insist on Valid RCMC in the case where it has been expired on before 31 March 2020, from the exporters for any incentive / Authorisations till 30 September 2020.

- Whether exporters need to pay the application fee for revalidation for the year 2020-21 to EEPC?

No, Export Promotion Councils (EPCs) will collect Application fees for the year 2020-21 only up on the restoration of normalcy.

Relaxation in Submission of Pre Application form under EU GSP Self- Certification:

Source: Trade Notice No. 61/2015-2020 dt.31/03/2020

- In the event of COVID-19 disruptions, how to obtain the REX number by the exporters under EU GSP Self-certification system?

Exporters can fill the Pre- Application form and send the scanned copies of Prefilled application along with required documents for issuance of REX numbers, REX numbers will be assigned by the authority by e-mail. (Instead of physical submission on Pre Filled application form for obtaining REX Number is waived till the COVID-19 Pandemic).

- If any deficiency identified in the Pre Filled application form submitted by the exporters, what is the procedure for rectifying the deficiency?

If any deficiency is identified or any additional documents required by the authority for issuance of REX number, the same shall be communicated to the exporters through e-mail. Upon receipt of the e-mail, the exporters can send the additional documents and rectify the deficiencies through e-mail for issuance of REX number.

Relaxation on Applications under SIMS

Source: Trade Notice No. 58 /2015-2020 dt.31/03/2020

- Whether the importers need to apply for the import of items for obtaining registration number as required by The Steel Import Monitoring System (SIMS)?

No, one Time relaxation is extended to importers owing to COVID-19 disruptions, the automatic registration number granted till 31st March’2020 has been extended with a valid period of 135 days instead of 75 days.

Relaxation in Issuance of Certificate of Origin

Source: Trade Notice No. 59/2015-2020 dt.28/03/2020

Trade Notice No. 62/2015-2020 dt.06/04/2020

Trade Notice No. 01/2020-2021 dt.07/04/2020

- In the event of difficulty in the issuance of Certificate of Origin by Indian agencies due to COVID-19 disruptions, is there any relaxation provided to exporters with respect certificate of origin?

In view of such exceptional circumstances, the certificates would be issued retrospectively by the concerned Indian agencies after the opening of their offices. Custom authorities and trade partners should allow eligible imports subject to the subsequent production of the certificate of origin by the Indian exporters.

- Is there any procedure announced to apply for a certificate of origin digitally through https://coo.dgft.gov.in ?

Yes, online applications can be applied by the exporters through https://coo.dgft.gov.in for issuance of Certificate of origin to the Indian authorized agencies. The exporters can download the digitally signed electronic certificate of origin from the portal w.e.f 07th April’ 2020 for submission. The physical signed copies of certificate of origin could be issued subsequently once the authorized Indian agencies resume their office after COVID-19 Lockdown.

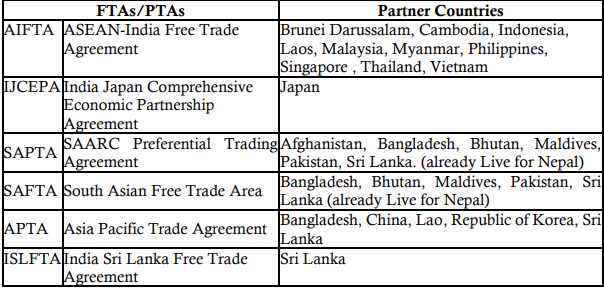

- Is there any List of PTAs & FTAs and partner countries notified for the issuance of electronically signed certificate of origin through the portal https://coo.dgft.gov.in, apart from existing PTA’s & FTA’s?

Yes, with effect from 07th April’2020, concerned agencies are directed to issue preferential CoO for the below mentioned FTAs/PTAs by using the platform https://coo.dgft.gov.in along with the exiting FTAs & PTA’s

- How to verify the authenticity of the electronic certificate of origin?

A traceability and verification functionality is already built into the eCoO Platform. Certificates issued on this electronic platform can be verified by scanning the QR code available on the certificate or by cross checking the authenticity of the certificate serial number on the platform at https://coo.dgft.gov.in

- Is there any fees involved for the issuance of a digitally signed certificate of origin?

Yes, Rs.600/- is prescribed as a uniform fees for all preferential certificate of origin irrespective of whether they are retrospective or not ( Instead of Rs.150 for normal application & Rs.250 for urgent application ).

- Will the trading partners accept the digitally signed certificate of origin instead of the physical certificate of origin duly signed by competent authorities?

Yes, Government of India has requested the trading partners of the importing countries to accept the digitally signed certificate of origin or the unsigned physical certificate of origin by the competent authority to clear the consignment provisionally at preferential duty as an interim relief measure till COVID-19 pandemic is over.

- Will the exporters need to submit any undertaking or bond to clear the consignment without a duly signed certificate of origin?

Yes, it depends on the conditions laid down by each importing countries, if required undertaking or bond to be submitted by the exporters stating that duly signed certificate of origin by the competent authority will be submitted subsequently after authorized Indian agencies resume their offices.

- Will India also allows the importers consignment from outside India to clear the consignment based on the production of a digitally issued certificate of origin or the unsigned physical certificate of origin?

Yes, already Government of India has relaxed the requirement and would clear the consignments provisionally with a digitally signed certificate of origin or unsigned physical certificate of origin against submission bond or undertaking or security as required by Customs.

- Will the online issuance of Certificate of Origin for the notified FTAs/PTAs continue even after the issuing agency offices resumes after COVID-19 Outbreak?

The certificate of origin issuance process will continue to remain online through this portal https://coo.dgft.gov.in.

Thenmozhi Krishnakumar

Manager-Finance

Aparajitha Corporate Services Private Limited

Disclaimer: “The article represents the opinions of the author and the author is solely responsible for the facts, cases and legal or otherwise reproduced in the article”